A Simple Beginners Tip to Save Money Effectively in 2023 | Save Money in India | DoDiscover and Develop

how to save money from salary | how to save money daily | how to save money in India as a student | I want to save money every month | how to save money at home | best way to save money | what is the smartest way to save money in India |

Happy New Year! How do you feel about having a New Year’s Resolution to Save money effectively with this One Effective Tip? Is it interesting to You?

This article is all about an effective, simple, and easy tip to build your savings journey. This tip will help students, housewives, and those who want to start some new, like a saving habit this year.

|

| A Simple Beginners Tip to Save Money Effectively in 2023 Save Money in India | DoDiscover and Develop |

What is Money?

According to Investopedia,

"Money is a medium of exchange; it allows people to obtain what they need to live. Bartering was one way that people exchanged goods for other goods before money was created. Like gold and other precious metals, money has worth because for most people it represents something valuable...a socially accepted standard unit with which things are priced."

Before money, people acquired and exchanged goods through bartering. The history of money has developed from bartering to banknotes to bitcoin. If you are interested to know the history of money, read the article from Investopedia.

Money as a Universal Medium of Exchange

Many people consider that the love of money has been described as “the root of all evil.” It’s true, that materialistic people can let an obsession with money drive them to do bad things for their own financial gain. But in reality, money is nothing more than a medium of exchange.

Why do we need money?

You may be wondering why I am explaining all these things here. We understood the definition of money, a medium of exchange that is socially acceptable. In our social life, sometimes, many problems have arisen due to people's "wants" for money. People think if money is there, all problems are solved. But let me tell you, money is like water. You need it to quench your thirst in the world.

Whenever you feel thirsty, you need to drink water, right? You need to drink water only when you feel thirsty. If you eat your favorite food when you need water, does the thirst end? No. When you feel thirsty, you want water only, none other than that.

Similarly, money is required to acquire worldly things like a home, vehicle, electricity, vegetables, etc. It is a means to get something higher and to do something else.

So, the ANSWER to WHY WE NEED MONEY is:

'Money is required as a means of doing something higher to ensure our well-being and peacefulness. To fulfill our basic desires, we require money; to say simply'.

"It is not an end if you have or don't have money. But if you have some desires to fulfill in life, very basic desires, then, it's better to have sufficient money. So, that you can be free from the tensions and you can focus on something else such as Your Self-improvement."

Benefits of Money

Freedom to use your time as you like -

- When you have enough money, you can live where you want, and focus on your hobbies. If you can become financially independent and have the financial resources necessary to live on without working, you’ll enjoy even more freedom since you will be able to do what you want with your time.

The power to pursue your dreams -

- If you have enough money, it is possible for you to start a business, build a dream home, pay the costs associated with your family, or accomplish other goals you think will help you live a better life.

Money gives you affordability to have basic facilities -

- When you have enough money in the bank, you don't need to worry about basic problems like not having enough to eat or being able to see a doctor when you’re sick. This doesn’t mean you’ll be able to afford everything you want, but you’ll be able to enjoy a stable middle-class life.

Why is it important to develop a habit of saving money effectively?

A lot more money doesn't make a lot more happiness. But money can provide security and safety for you and your loved ones. Human beings need money to pay for all the things that make their life possible, such as shelter, food, healthcare bills, and a good education. You don’t necessarily need to be a crorepati to pay for these things, but you will need some money until the day you die.

It is necessary for obtaining the goods and services you need to survive. So, you need to be responsible with the money you earn or you have and save enough for the future to ensure you will still have enough leftovers when you can no longer provide labor services for money.

It doesn't matter at what age you begin saving money for your near and dear ones, start sooner, so, that you’ll never face a lack of money or financial stress in the upcoming days.

How to save money as a beginner?

Saving is the amount that you keep aside from your current expenditure. You keep these savings amounts for a long time such as 10 years, 15 years 20, and 25 years. Then for highly purposeful needs, you are using the saved amount. Let's understand the process of saving money.

What are savings?

The general definition of savings can be the amount of money left over after spending and other obligations are deducted from earnings.

- The process of saving money can be understood by the following formula,

Income - expenditure = Savings

- When you follow this formula and try to save money; you may not be able to save consistently. So, you need to change the formula like

Income - Savings = Expenditure

If you followed this formula of saving money, i.e, you keep some money as a savings amount whenever you get some money; thus, consistency in saving money can be a habit of yours. This formula can be applied even if you are not earning a regular income based on a full-time job.One Effective Method to Save Money

Before explaining that one effective method, I would like to thank the host of the Rupee monk YouTube channel who shared this wonderful tip to save money. That is ONE RUPEE SAVING SCHEME TO GENERATE 66795.- Start saving from one rupee for one year time period in such a way that

Day 1 - Save one Rupee

Day 2 - Save two Rupees

Day 3 - Save three Rupees ... Thus, Day 365 - Save 365 Rupees. That's it.

- When you calculate all these savings amounts, you will be having 66795 Rupees.

You may think 'Is it possible for me to do this consistently?'It is a good question. Because most of the time, we start something enthusiastically. After two days of doing a new task, we leave it aside and move on. This is a general thing. But those who overcome this inertia will be successful.

- Start saving from one rupee for one year time period in such a way that

Day 2 - Save two Rupees

Day 3 - Save three Rupees ...

- When you calculate all these savings amounts, you will be having 66795 Rupees.

Now, let's look into the consistency of this saving task.How to save consistently with this effective tip for saving money?

There are some tips to have consistency in doing this task of saving money based on the 'One Rupee Saving Scheme'.

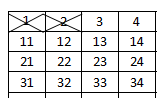

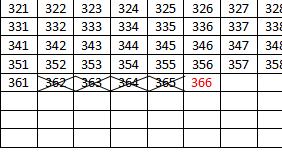

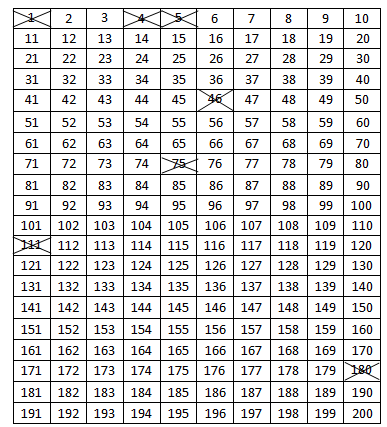

STEP 1 Prepare a Chart for Recording your Savings

- Take a chart paper or white card you get when you buy clothes from a textile shop to mark your savings amount. Draw a table of numbers from 1-365 manually.

- You can use MS Word or Doc to prepare the table and paste the printout on chart paper or white card to save time. Here is a sample you can download and modify as per your creativity and aptitude.

STEP 2 Cut the Number on the Card while saving that Amount as Savings

- Hope that you get an idea of preparing the chart of 1-365 (366 for leap year). Whenever you save Rupees 1, 2, 3, etc, you cross the number on the card.

- For example, on Day 1, I saved one Rupee, so, immediately after putting one rupee in my saving deposit box or transferring one rupee into my savings bank account, I will take this card and cross the number '1'. Similarly, On Day 2, after putting two Rupees as savings, I will mark a cross on the number '2'.

Thus, I will be crossing the number whenever I save money as per this method.

Thus the activity goes on. Note: You can save from 365-1 also and cross the number accordingly.

- The point is you need to track your progress in this activity. Whether you mark it in these ways or do it by highlighting the numbers or any other methods, it is your choice.

- When you cross all numbers by one year time, you will be having a savings amount of Rs. 66795

- This is possible because of the compound effect.

Note: Don't take your saving money in between that one year. Then only, you can experience this compound effect. After one year, you can do whatever you want with this savings amount.

STEP 3 Have a separate Savings account only for Saving money

People without a bank account will be very rare. Because everyone is switching to digital transaction payment methods. It is easier and safer than compared to offline transactions via cheque, etc. Therefore, it is clear that everyone has at least one bank account for necessary transactions.- If you are the sole earner of your family, then it is better to have a separate bank account only for effective Saving purposes. Or

- If your second bank account is having less money and doing no transactions for the time being, then, you can use it as Savings (only) bank account.

This disintegration between a Savings bank account and a Savings-only bank account will help you not to take your savings amount before completing one year of savings duration as per the 'One Rupee Saving Scheme' method.

If you find any other ideas for effective Savings, please let me know in the comment section. That will be useful for me as well as the readers.

One Rupee Saving Scheme Save Money FAQ

Qn.1) When should I start to save money?

- When you feel it is essential to save some money for certain requirements. So start from today onwards. In other words, when you have the desire to buy or get something, start to save money to fulfill your materialistic needs if that requires money. Don't wait for a good time after the 30-s or 50-s or 60-s. Start now, if you have the desire to buy or get something that requires money.

Qn.2) How do I save 25k?

- You can save 25,000 Rupees through the One Rupee Saving Scheme Method. If you find it difficult to save in one go, you can save like

On Day 1- Saving One Rupee On Day 2- Two Rupees savings On Day3- Three Rupees Thus you can save up to 25k or more as per your needs.

- Another method is to save an equal amount of money per month until it reaches 25,000. For example, divide 25, 000 by 5, and you will get 5000. If you save 5000 Rs per month. After 5 months, you will be having Savings of Rs. 25,000.

Qn.3) How can I save 3000 in 6 months?

- Divide 3000 by 6, and the answer is 500. Save Rs. 500 per month. After 6 months, you will be having 3,000 Rupees as Savings. Do not take this savings amount until you reach your targeted time of 6 months.

Qn. 4) How can I save $1000 fast?

- You can save money via this saving method as shortly described in this article. Instead of saving Rupees, you have to save dollars like, 'On Day 1- Save $1'; 'On Day 2 - Save $2'; Thus, finally, on 'Day 365 - $365'. Likewise, anyone can save as per this method in their value of the currency, i.e, in Indian Rupee, USD, Euro, etc.

Specific Questions related to this Post

Qn.5) What should I do if I fail to do 'ONE RUPEE SAVING SCHEME'?

Answer) No issues. You may start again. Try to maintain consistency in what you are doing. Save a little in the beginning. Slowly, slowly, you will improve. Your attitude towards this activity and little effort matters. Don't try any shortcuts.

Qn.6) Could you explain the mathematical operation behind the One Rupee Saving Scheme?

Answer) It is a simple arithmatic operation taught in schools.

To explain briefly, let's take an arithmetic progression of 1, 2, 3, and 4 as first, second, third, and fourth terms respectively. i.e., First term (n1) =1n2 = 2n3 = 3n4 = 4

Sum of 1-4 terms of this Arithmetic Progression = n1 + n2 + n3 + n4 = 1 + 2 + 3 + 4 = 10In method two, the Nth term is multiplied by the Nth term plus one and divided by two. Nth term x (N + 1) divided by twoThat is, Sum of numbers in this Arithmetic Progression = N4 x (N4+1) / 2 = 4 x 5 / 2 = 20/2 =10Similarly, Nth term = 365So, Sum of 365 terms = N365 x ( N365 + 1) divided by 2 = 365 x 366 / 2 = 133590 / 2 = 66795Hence, 66795 is the final answer.

Reference

1. Rupee Monk Channel - ONE RUPEE SAVING SCHEME TO GENERATE 66795 | MULTIPLY AND SAVE MONEY (MALAYALAM)Similar videos in other Indian languages

2. Happy O Happy - தினமும் 1 ரூபாய் சேமித்தால் ஒரு வருடத்தில் ₹66795 கிடைக்கும் | Save 1 Rupee and Get ₹66795 In 1 Year (Tamil Language)

3. Success 555 Civil Engineer - 36 | Save Daily Rs.1 Challenge&Get Rs.66795 1 Year Plan for Students, House wives #Success555 (Hindi Language)

4. Suman TV Entertainment - Save 1 Rupee Per Day After 365 Days You Will Get Upto 60000 | How To Save Money (Telugu Language)

In this article, we have tried our best to explain one simple and effective tip to save money as a beginning step. Perseverance, discipline, and consistency are the keys to experiencing how this simple tip works for you.Hope you enjoyed this article.

If you find any other ideas for effective Savings, please let me know in the comment section. That will be useful for me as well as the readers.

DISCLAIMER — This post contains no affiliate links. The idea provided to save money here is curated from one of the YouTube channels but is effective if followed properly. The source of the main idea covered in this article is the Rupee Monk YouTube channel. The link for the YouTube video is provided above as a reference in the comment section.what are some ways or tips to save money in everyday life when living in India | how to save money | importance of savings | save your money | how can I save 10000 in 12 months | how do you save monthly |

- Take a chart paper or white card you get when you buy clothes from a textile shop to mark your savings amount. Draw a table of numbers from 1-365 manually.

- You can use MS Word or Doc to prepare the table and paste the printout on chart paper or white card to save time. Here is a sample you can download and modify as per your creativity and aptitude.

- Hope that you get an idea of preparing the chart of 1-365 (366 for leap year). Whenever you save Rupees 1, 2, 3, etc, you cross the number on the card.

- For example, on Day 1, I saved one Rupee, so, immediately after putting one rupee in my saving deposit box or transferring one rupee into my savings bank account, I will take this card and cross the number '1'. Similarly, On Day 2, after putting two Rupees as savings, I will mark a cross on the number '2'.

- The point is you need to track your progress in this activity. Whether you mark it in these ways or do it by highlighting the numbers or any other methods, it is your choice.

- When you cross all numbers by one year time, you will be having a savings amount of Rs. 66795

- This is possible because of the compound effect.

- If you are the sole earner of your family, then it is better to have a separate bank account only for effective Saving purposes. Or

- If your second bank account is having less money and doing no transactions for the time being, then, you can use it as Savings (only) bank account.

- When you feel it is essential to save some money for certain requirements. So start from today onwards. In other words, when you have the desire to buy or get something, start to save money to fulfill your materialistic needs if that requires money. Don't wait for a good time after the 30-s or 50-s or 60-s. Start now, if you have the desire to buy or get something that requires money.

- You can save 25,000 Rupees through the One Rupee Saving Scheme Method. If you find it difficult to save in one go, you can save like

- Another method is to save an equal amount of money per month until it reaches 25,000. For example, divide 25, 000 by 5, and you will get 5000. If you save 5000 Rs per month. After 5 months, you will be having Savings of Rs. 25,000.

- Divide 3000 by 6, and the answer is 500. Save Rs. 500 per month. After 6 months, you will be having 3,000 Rupees as Savings. Do not take this savings amount until you reach your targeted time of 6 months.

Qn. 4) How can I save $1000 fast?

- You can save money via this saving method as shortly described in this article. Instead of saving Rupees, you have to save dollars like, 'On Day 1- Save $1'; 'On Day 2 - Save $2'; Thus, finally, on 'Day 365 - $365'. Likewise, anyone can save as per this method in their value of the currency, i.e, in Indian Rupee, USD, Euro, etc.

Specific Questions related to this Post

Qn.5) What should I do if I fail to do 'ONE RUPEE SAVING SCHEME'?

Qn.6) Could you explain the mathematical operation behind the One Rupee Saving Scheme?

To explain briefly, let's take an arithmetic progression of 1, 2, 3, and 4 as first, second, third, and fourth terms respectively. i.e.,

Comments

Post a Comment

Comment here